The CMR Reset: How Early Action in 2026 Will Separate the Best from the Rest

Introduction

The CY27 Advance Notice is out and included many consequential shifts. The MA rate increase was nearly flat and well below expectations, while CMS also introduced material tightening of risk adjustment processes. Along with those headline generating changes, CMS included confirmation in the notice that the MTM Program Completion Rate for Comprehensive Medication Review (CMR) is returning as a Star Ratings measure. After spending two years on the Display Page, the measure is being reinstated—reflecting CMS’s renewed emphasis on medication therapy management and its role in driving patient outcomes.

This change— signaled again this week in CMS’s 2027 Advance Notice and previously in the 2027 Star Ratings Measures and Weights has major implications for Part D plans, MTM vendors, and overall Stars strategy.

https://www.cms.gov/files/document/2027-star-ratings-measures.pdf

https://www.cms.gov/files/document/2027-advance-notice.pdf

Key Highlights

If you don’t read any further know these three things:

1. Health Plan Star Ratings Strategy Must Re‑Elevate MTM

With the CMR measure returning, plans must once again treat MTM performance as a lever with direct impact on their overall Stars score and quality bonus payments.

2. Operational MTM Models Need Scaling Ahead of MY 2027

Plans that downsized MTM operations or deprioritized CMR engagement during the Display Page years will need to rebuild capacity—often significantly—to remain competitive once scoring resumes (see my cutpoint predictions below to learn by how much)

3. Opportunity to Reset Performance Baselines

Because CMS is treating the CMR measure as new, plans have a rare opportunity:

- Fresh cut points

- Re‑established national performance distributions

- A chance to leapfrog competitors with early investment

Why CMS Is Bringing Back the CMR Completion Rate

CMS's decision fits into its broader goals for Part D modernization:

- Strengthening medication safety and therapy management.

CMS continues to emphasize safe medication use, adherence, and patient‑provider engagement. Returning the CMR measure integrates these goals directly into plan accountability frameworks. [pqaalliance.org] - Ensuring alignment across Star Ratings and quality domains.

CMS has been refining Stars to focus on clinical outcomes and quality interactions. The CMR measure contributes directly to patient understanding of medications and reduces preventable harms—both priority areas in recent rulemaking. However, let's not misrepresent things here, the CMR Completion Rate is still a process measure. Expect CMS to continue to apply pressure to the industry to align on a new outcome-focused measurement tool. - Leveraging MTM programs as a patient‑facing quality lever.

MTM programs have historically produced measurable clinical and economic benefits. At the core of the CMR is the mission to empower patients to self-manage their medication and health conditions. Reintroducing the CMR Completion Rate as a scored measure re‑centers MTM as a Stars‑relevant offering for plans.

What Plans Should Do Now: MY26 Ramp‑Up and MY27 Execution Strategy

With the CMR Completion Rate returning to Star Ratings for Measurement Year 2027, plans have a unique two‑year window to rebuild capacity, strengthen MTM operations, and position themselves for the aggressive cut‑point environment our modeling predicts. MY26 becomes the critical ramp‑up year, while MY27 is the make‑or‑break performance year.

1. Treat MY26 as the Operational Ramp‑Up Year

Although the measure remains on the Display Page in 2026, the work plans complete this year will determine their competitive position once 2027 begins.

Key 2026 Priorities

- Rebuild MTM operational muscle

Plans should re‑expand the strategies that were downsized during the display period. - Stress‑test outreach models

Dry‑run the outreach cadence, channel mix, and workflow routing that will be required to hit the high MY27 thresholds. - Adopt leading indicators tied to predicted cut points

Use the MY27 predictions as your internal benchmarks now — not later. - Integrate precise targeting models

With the MTM program, plans need algorithmic identification for:- members with high CMR completion likelihood

- members needing pharmacist‑led conversations

- members requiring multi‑touch approaches

Outside the MTM program, plans must evaluate how IRA policies that reduce beneficiary outofpocket drug costs may alter members’ progression toward total drug spend thresholds—potentially changing both MTM eligibility timing and the volume of members qualifying for intervention.

- Reduce friction in documentation and data flow

CMS’s reactivation means documentation quality, encounter accuracy, and data timeliness matter again; start correcting upstream issues now.

MY26 is the last low‑risk environment before CMS resumes scoring plans that wait until MY27 to scale will immediately fall behind the predicted curve.

2. Align MY27 Performance Strategy Directly to the Predicted Cut Points

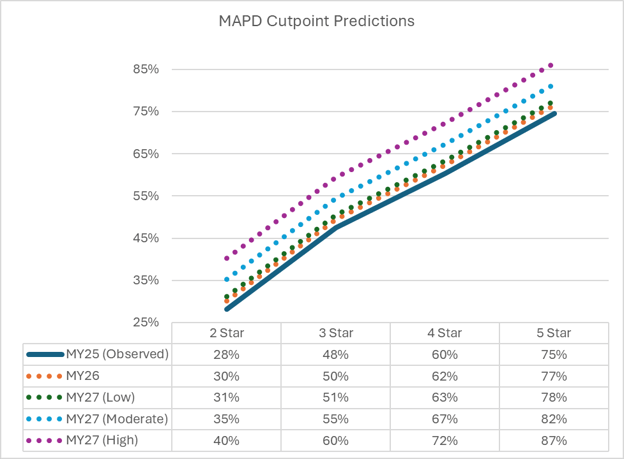

The latest cutpoint modeling shows just how quickly the competitive landscape will shift once CMS reactivates the CMR Completion Rate as a scored Star Ratings measure in MY27.

Why plans need MY27 execution precision

- CMS will treat the CMR measure as a new measure, resetting its distribution.

- Observed MY25 CMR performance shows a clear center of gravity around 48–60% for 3 and 4star performance.

- MY26 climbs only slightly, but MY27 introduces a step change, even in the low activity scenario.

- In moderate and high scenarios, the 4 and 5star bands accelerate most sharply, outpacing growth in the bottom and lower middle tiers.

Plans that do not start MY27 well above the lower prediction bands — ideally, operating early in the year at or near the moderate scenario levels — may find themselves effectively locked out of 4 and 5star territory, even if their performance improves later in the year.

At a macro level the CMR now becomes a gatekeeper of measures for upper-tier performance. Rewarding plans that can execute complex, patient-facing processes consistently at scale.

3. Build a Two‑Year CMR Roadmap (MY26 → MY27)

Phase 1 — MY26 (Build & Prove)

- Scale operations and outreach

- Tune predictive models

- Pilot multichannel sequencing (SMS → phone → pharmacy)

- Close documentation gaps

- Achieve internal targets tied to MY27 projections

Phase 2 — MY27 (Execute & Optimize)

- Daily/weekly performance dashboards against predicted cut‑point trajectories

- Rapid‑cycle adjustments to outreach and provider channels

- Tiered escalation workflow for at‑risk members

- End‑of‑year compression strategy: highest‑yield subgroup targeting when plan performance curves tighten

Data Insight – MTMP Identification Rates

Last but not least, is the underlying MTMP identification criteria changes that resulted in the substantive changes that caused CMS to move the CMR completion rate to the display page for two years.

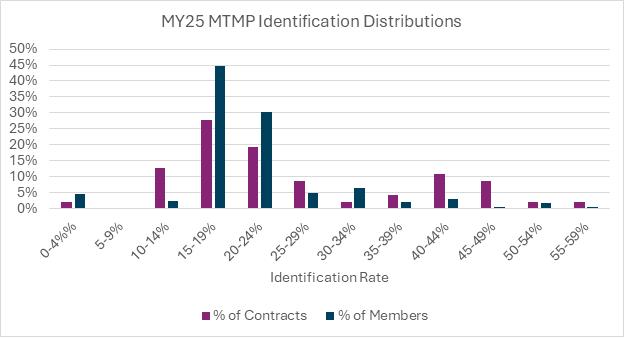

Our MY25 analysis shows that actual identification rates across plans are substantially higher than CMS’s expected national identification rate of 13%, which CMS used when finalizing the MTMP expansion.

- Mean identification rate: 26%

- Median: 21%

- Standard deviation: 13%

These numbers tell us three things:

1. The industry is identifying nearly 2× the rate CMS modeled.

This suggests identification criteria are pulling in broader populations than CMS originally projected — likely tied to expanded chronic condition burden, medication complexity, and polypharmacy prevalence.

2. Plans need to ensure they remain “within the pack,” not at the extremes.

Because the identification rate distribution is wide (SD = 13%), plans that fall well below or above the pack may appear misaligned with CMS expectations or peer behavior — a subtle but important governance consideration heading into MY26/MY27.

3. Higher identification isn’t a performance advantage — but it does influence operational load for MY27.

A plan identifying at 25–30% today will need more:

- workflow capacity

- vendor scalability

- documentation throughput,

- and most importantly budget to meet MY27’s predicted CMR cut points.

This reinforces why MY26 is the rampup year: plans must rightsize operations not because identification must increase, but because identification is already higher than CMS expected, and MY27 will require completing more CMRs earlier to maximize both Stars performance and $4,000 average TCoC savings.

Conclusion

CMS’s confirmation that the CMR Completion Rate returns to Star Ratings for MY 2027 marks a major shift in Part D quality strategy. Plans that act early—strengthening MTM programs, raising CMR engagement, and partnering with high‑quality MTM vendors—will be best positioned for the competitive landscape of the 2029 Star Ratings cycle.

This reinstatement reaffirms what many in the industry have long recognized: CMRs are foundational to medication safety, adherence, and member experience—and now once again, to Stars performance.